Same Day Payday Loans In Cincinnati Ohio

Are you looking for a payday loan in Cincinnati, Ohio? Many payday loan companies are out there, but sometimes, finding the best one can be tricky. Below is a guide to help define what makes a payday loan company good or bad and how to find the best lender.

Most people realize that unsecured personal loans are a quick way for someone who needs money now to get it, with little time required to spend on getting their application approved. A borrower living in Cincinnati typically has until their next paycheck before paying back all of their borrowed money plus interest. If they cannot afford to pay back this debt at any point during that time, they may extend it by paying just the interest again, meaning that they roll over the amount due to the next pay period.

How Do Residents Of Cincinnati Use These Types Of Loans?

These loans can be anything from small amounts for car repairs to more significant amounts that allow people to deal with emergencies such as losing their jobs. As we all know, the economy can get tight in Hamilton County, and many residents need cash to pay for emergency expenses.

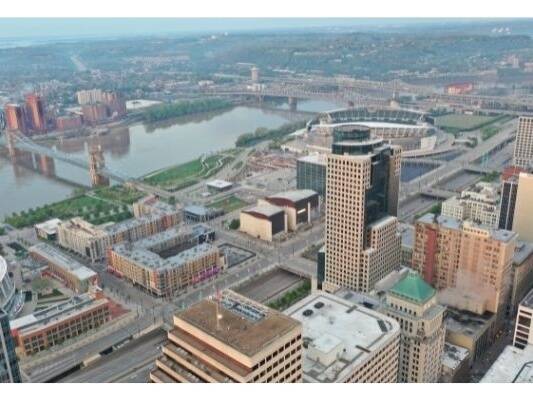

People who live in Cincinnati can use and access these types of payday loans by applying online or with a local finance company. Most finance companies in Cincinnati are dedicated to providing residents with quick cash that can be used for their needs. That means you always have the choice to apply online from the comfort of your home. But you can also walk in and meet with a neighborhood payday loan company near you in diverse areas of town ranging from The Banks to Clifton or even Evanston.

What Are The Current Requirements For A Cincinnati Ohio Payday Loan

To qualify for online payday loans in Ohio, you must typically meet several requirements before any state licensed payday lender will agree to lend you cash. These essential criteria include having a job, providing income via pay stubs or direct deposit slips, and having an active checking account. Further, you must be at least 18 to apply for this type of cash advance financing in Ohio.

Do I Need A Good Credit History For Online Payday Loans In Cincinnati

No, you can still be approved for an online payday loan in Ohio if you have bad credit or no credit history. These loans come with high interest rates and because of that, your credit report is not as important as if you were applying for an installment loan or cash advance from your bank. Remember that payday lenders will not give you access to roll over the loan until after you have paid them back with your next paycheck, so it is best to plan accordingly when taking out fast payday advances online.

Who Can I Turn To For A Payday Loan With No Checking Account In Cincinnati

If you do not have an active checking account, other options are available for Ohio residents who need payday loans without a checking account. If this applies to you, consider applying for an instant payday loan via direct deposit with any online payday loan companies listed in our directory. While it’s harder to qualify without a checking account, getting funded is still possible.

Some payday loan companies will do a soft pull on your credit report as part of their application process to see if you have a bank account. If you’re rejected for a payday loan because of an issue with your credit, the decision cannot be used to impact your credit score negatively! Apply now with Payday Loans Ohio online, and we’ll get your instant quote with payment options in less than 15 minutes!